Dollar Unwinding After Noisy Geopolitical Week

Dollar Heading Lower

The US Dollar is on course to end the week lower with the DXY down around 1.255, as of writing, following a reversal from last week’s highs. The move lower comes amidst a volatile macro backdrop this week. The opening theme for the week was Trump’s renewed commitment to secure Greenland, threatening tariffs against eight European countries unless they co-operated with his agenda. This threat was met with the promise of counter action from the EU, sparking trade war risks which led to a flight to safety. Gold has been the standout winner this week with the metal surging higher on elevated safe-haven demand while USD fell.

Trade War Risks Fade

These risks were unwound mid-week after Trump announced that he was scrapping tariff threats against Europe, noting that talks had led to the creation of a framework for a future deal on Greenland. While details are still forthcoming, the walking-back of trade-war risks has been welcomed by markets with risk assets rebounding accordingly. USD has remained weak in this environment with traders returning to typical macro drivers and the prospect of Fed rate cuts this year.

PMIs Due

Looking ahead today, focus will be on the latest US flash PMI data due this afternoon with both services and manufacturing expected to have risen against the prior month. Alongside this, traders will be monitoring any incoming headlines or noise around the Greenland deal, wary that Trump could resume hostility at a moment’s notice.

Technical Views

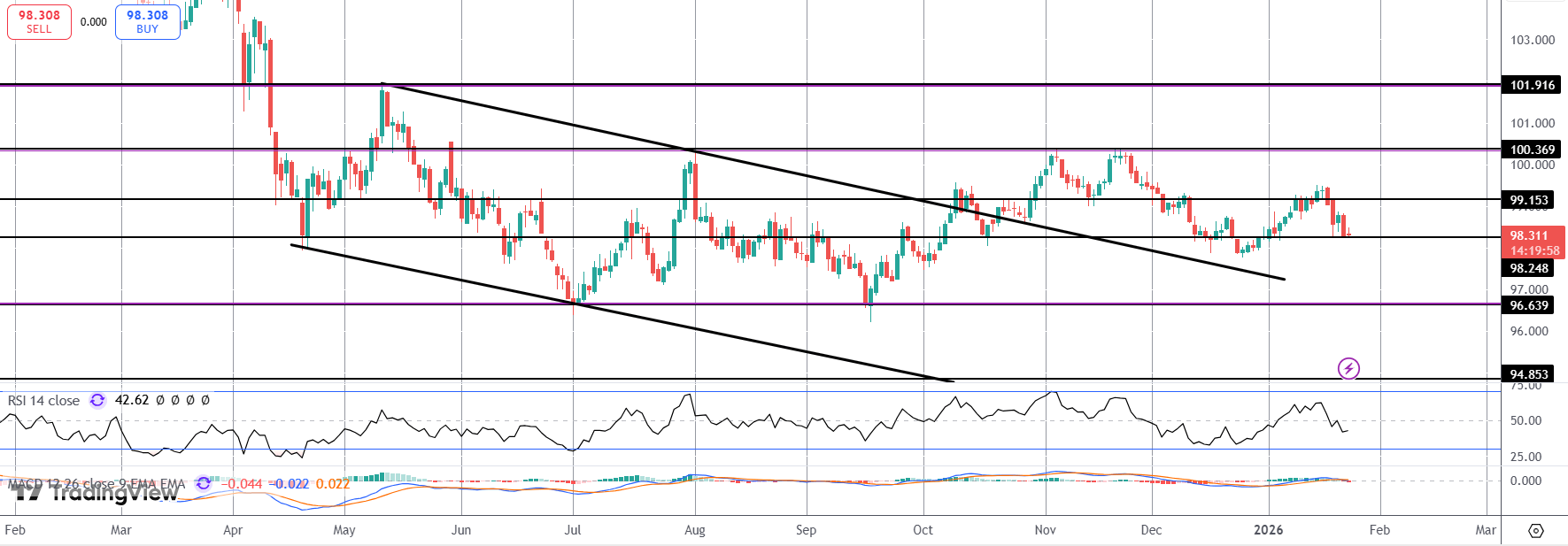

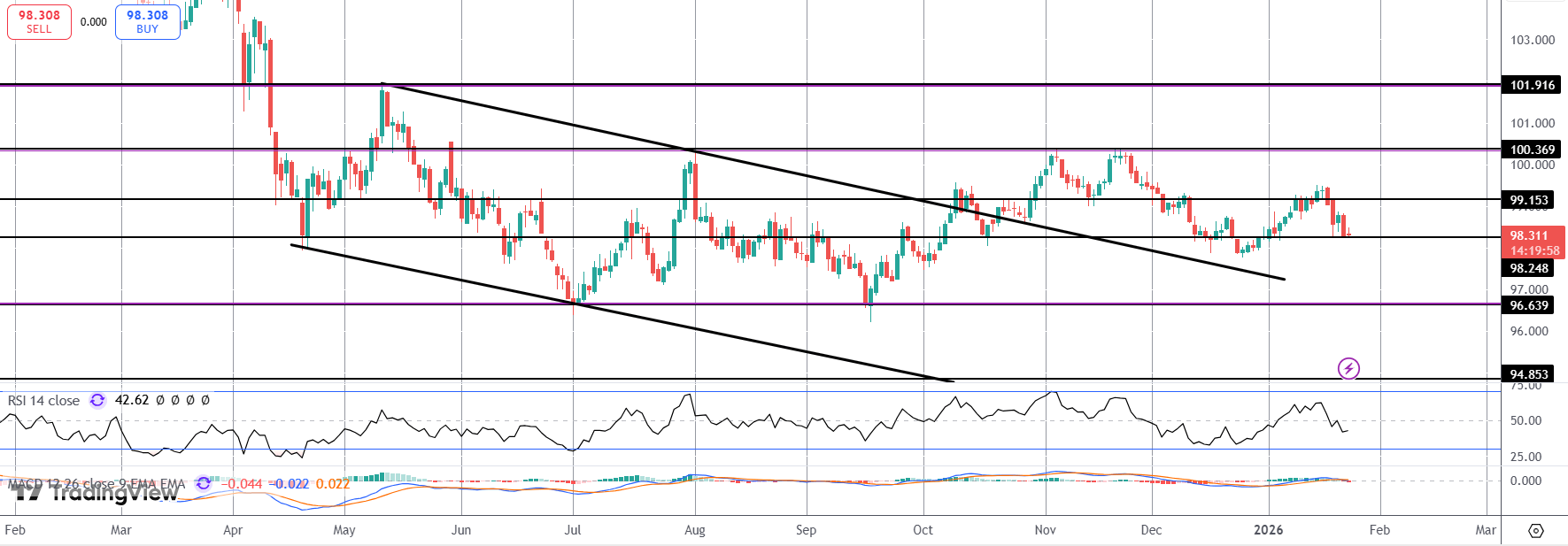

DXY

The failure at 99.15 has seen the market turning back down towards the 98.24 support, where price is currently stalled. With momentum studies now bearish, risks of a fresh push lower are seen with 96.63 the next support to watch if we breakdown further. Topside, 10.36 is the next target for bulls if price gets back above 99.15 near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.