Institutional Insights: Credit Agricole FX Weekly 16/1/26

We were so wrong, or were we?

- We, along with most of our clients, anticipated that 2026 would surpass 2025 in terms of economic stability due to diminishing policy risks from the White House. This assumption was grounded on two factors: (1) the Trump administration had largely fulfilled its fiscal, trade, and immigration policy objectives by 2025, and (2) the focus in 2026 would shift towards securing the midterm elections, prioritising economic support over disruptive populist policies.

- However, as we enter mid-January, it’s clear this perspective hasn’t held up well. We now acknowledge that geopolitical risks may persist longer than expected, potentially delaying global economic recovery and moderating inflation. Simultaneously, we believe US economic priorities will take precedence over fiscal dominance efforts, and the Fed may yet surprise markets with less dovish actions than anticipated.

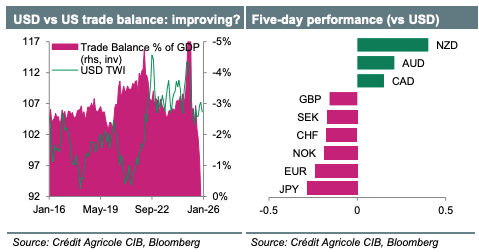

- Regarding our FX outlook, recent developments have reinforced our positive stance on the USD and XAU, driven by their increased safe-haven appeal. The robust US economic prospects, partly due to improving external imbalances, could challenge the market’s dovish expectations for the Fed, further bolstering the USD. Meanwhile, escalating geopolitical tensions amplify our bearish outlook on the EUR and CAD, as the Eurozone and Canada could emerge as significant casualties of the US-China standoff and other geopolitical conflicts.

- Looking ahead to next week, the US data calendar appears light, featuring November Core PCE and January PMIs. FX investors may instead focus on geopolitical updates, with the World Economic Forum in Davos likely serving as a key event. Additionally, market participants will closely watch the SCOTUS decision on Trump-era tariffs and attempts to dismiss Fed official Lisa Cook. In other regions, UK labor, CPI, retail sales, and PMI data, alongside Eurozone PMIs and Germany’s ZEW survey, could draw attention.

- The JPY is expected to remain volatile as Prime Minister Sanae Takaichi prepares to announce a snap election, raising questions about her ability to translate her popularity into a Diet majority and the potential for FX intervention. The BoJ is projected to maintain its current stance next week, signaling a cautious approach to rate hikes, which offers little support for the JPY. Comments from BoJ Governor Kazuo Ueda on JPY weakness could also spark market volatility. Similarly, the Norges Bank is likely to hold steady, as persistent inflation and resilient economic activity make it premature to hint at further easing

FX & Gold Outlook

### 🇪🇺 EUR / 🇺🇸 USD — Bearish EUR/USD

- Many EUR positives (ECB path, European fiscal stimulus) and USD negatives (US growth/Fed worries) are already priced in.

- The “**sell America**” trade has not materialised: foreign inflows into US capital markets have been strong, easing fears around US external imbalances.

- France political risk could linger in H1 2026, creating a headwind for the EUR.

- Bottom line: EUR may struggle to sustainably outperform USD; expectation is renewed EUR/USD weakness through 2026.

Near-term upside risks for EUR/USD:

- 🇺🇸 Trump attacks on Fed independence.

- 🇺🇸 More persistent weakness in US data after the government shutdown.

### 🇺🇸 USD (broad) — Rebound bias in 6–12 months

- Recent USD strength partly reflects fading fears about:

- aggressive portfolio outflows from 🇺🇸 assets

- USD reserve-currency erosion

- Some USD negatives could still linger near term (growth worries, fiscal dominance fears).

- But over 6–12 months, USD should benefit if:

- 🇺🇸 growth recovers

- inflation stays sticky

- the Fed remains independent

- This could force markets to unwind a too-dovish Fed path, supporting USD via rate appeal and reduced demand for short-USD hedges.

- “US exceptionalism” is viewed as intact, supported by persistent inflows and possibly more 🇺🇸 FDI in 2026.

---

### 🇨🇭 CHF — Gradual depreciation

- After reaching decade highs vs 🇪🇺 and 🇺🇸 in Q4 2025, CHF has cooled entering 2026.

- Likely to depreciate slowly as it becomes a funding currency, assuming no major global shock.

- Low Swiss inflation and steady growth should limit nominal downside.

---

### 🇯🇵 JPY — Politically pressured, but key stagflation hedge

- Expect PM Sanae Takaichi to weigh on JPY by:

1) holding back BoJ rate hikes

2) higher fiscal spending supporting 🇯🇵 equities (Nikkei)

3) raising fiscal sustainability concerns

- Constraint: inflation is politically sensitive; if JPY weakness worsens inflation, pressure to tighten rises.

- BoJ comfort zone for 🇺🇸 USD/🇯🇵 JPY: 145–155.

- A move above 155 increases odds of faster normalization in Japan.

- Rising risk of 🇺🇸 stagflation → JPY seen as best hedge.

---

### 🇬🇧 GBP / 🇪🇺 EUR — Constructive GBP vs EUR (3–6M)

- Supportive factors:

- fading fears of UK fiscal austerity dragging growth

- abating UK stagflation risks, enabling BoE support

- GBP already prices many negatives

- autumn statement helped sovereign creditworthiness

- Expect BoE cuts, but market pricing is seen as too dovish → room for GBP to recoup ground vs EUR.

---

### 🇺🇸 USD / 🇨🇦 CAD — Downtrend toward 1.35

- USD/CAD broke its uptrend channel (H2 2025) on upbeat 🇨🇦 data.

- Pair has tracked tighter rate differentials; could continue.

- Base case: gradual move toward 1.35 in 2026.

- Watch noise from 🇺🇸🇨🇦🇲🇽 USMCA review.

---

### 🇦🇺 AUD / 🇺🇸 USD — Steady grind higher

- Drivers:

- 🇦🇺 resilience to US tariffs

- firm risk sentiment

- rising expectations of RBA hikes

- Headwinds:

- 🇨🇳 weak China growth

- stronger 🇺🇸 USD

- low Australian productivity growth

---

### 🇳🇿 NZD / 🇺🇸 USD — Slow grind higher

- Drivers:

- 🇳🇿 economic bounce + rising odds of RBNZ hikes

- firm soft commodity prices

- less US equity outperformance vs Asia

- Headwinds:

- stronger 🇺🇸 USD

- 🇨🇳 soft China growth

---

### 🇳🇴 NOK — Long-run appreciation bias

- NOK has faced setbacks, but:

- fundamentals remain robust

- rate appeal persists even with frontloaded easing expectations

- Appreciation continues if no major global “fracas” (risk-off shock).

---

### 🇸🇪 SEK — Needs proof to extend gains

- SEK outperformed in 2025 as a high-beta 🇪🇺-proxy.

- For more gains in 2026, markets need clearer evidence 🇸🇪 Sweden is outperforming the Eurozone.

- Riksbank FX reserves hedging could still cap SEK recovery.

---

## 🥇 Gold outlook

### 🥇 XAU — Supported in 2026

- Supported by worries that:

- rising government borrowing + sticky G10 inflation makes debt harder to absorb

- fiscal dominance fears could weigh on 🇺🇸 real yields (supportive for gold)

- What would weaken gold:

- a clear rebound in 🇺🇸 growth plus higher real rates/yields, which would dent XAU strength.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!